Mortgage calculator with additional annual payments

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Extra Payment Calculator Is It The Right Thing To Do

Purchase price Down payment Amortization period number of years 1 Year 2 Years 3 Years 4 Years 5 Years 6 Years 7 Years 8 Years 9 Years 10 Years 11 Years 12 Years 13 Years 14 Years 15 Years 16 Years 17 Years 18 Years 19 Years 20 Years 21 Years 22 Years 23.

. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

The mortgage amortization period is how long it will take you to pay off your mortgage. Our calculator includes amoritization tables bi-weekly savings. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules.

Building a Safety Buffer by Making Extra Payments. Make more frequent payments. This FHA loan calculator provides customized information based on the information you provide.

But it assumes a few things about you. Such as a one-time upfront mortgage insurance premium MIP and annual premiums paid monthly. Lenders define it as the money borrowed to pay for real estate.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. By making additional monthly payments you will be able to repay your loan much more quickly. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

Check out the webs best free mortgage calculator to save money on your home loan today. Loan Amortization Calculator. Mortgage insurance is only available when the purchase price is below 1000000.

In addition to making extra payments another great way to save money is to lock-in historically low interest rates. Using our mortgage rate calculator with PMI taxes and insurance. Since mortgage payments comprise a substantial part of your debt.

Number of Regular Payments. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

What Mortgage Can I Afford Calculator. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. The calculator is mainly intended for use by US.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. The most common mortgage term in Canada is five years while the most common amortization period. Calculate loan payment payoff time balloon interest rate even negative amortizations.

See a breakdown of your monthly and total costs including taxes insurance and PMI. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Use our free monthly payment calculator to find out your monthly mortgage payment.

Additional Income monthly 600. A mortgage is a loan secured by property usually real estate property. Whatever the frequency your future self will thank you.

Brets mortgageloan amortization schedule calculator. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Pay off your 400000 30-year mortgage in a little over 25 years and save over 36000 in mortgage interest by making 200 additional payments.

Number of Extra Payments. Pay this Extra Amount. The FHA mortgage calculator includes additional costs in the estimated monthly payment.

This covers your mortgage payments in case of unexpected events that cause significant income loss.

Downloadable Free Mortgage Calculator Tool

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Extra Payment Mortgage Calculator For Excel

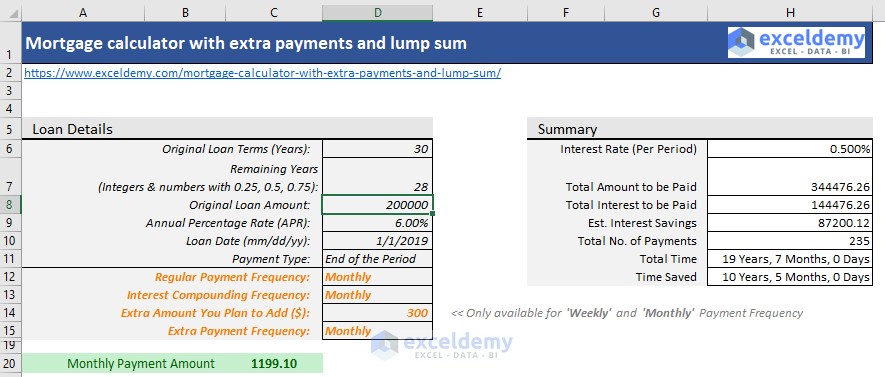

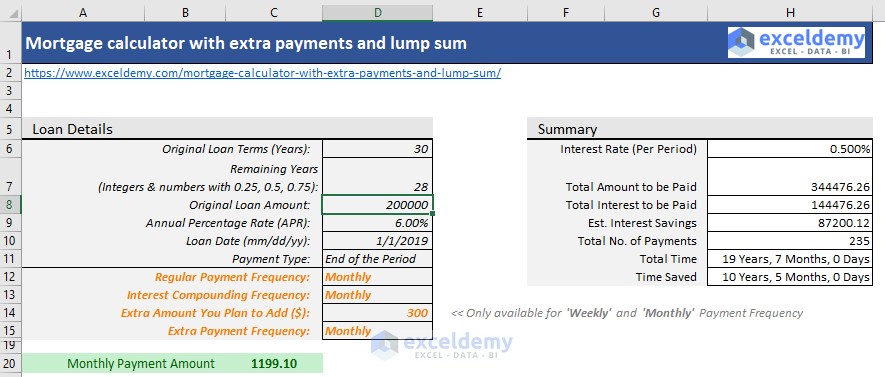

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Biweekly Mortgage Calculator How Much Will You Save

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Calculator Is It The Right Thing To Do

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Free Interest Only Loan Calculator For Excel

Loan Repayment Calculator